Since swing traders let those trades perform for days or weeks and aim for a higher profit target, profits are usually higher than with day trading. Let's know what is day trading and swing trading?

DAY TRADING VS SWING TRADING? SAME THING???? YouTube

DAY TRADING VS SWING TRADING? SAME THING???? YouTube

It is true that swing trading is not time consuming when compared with day trading.

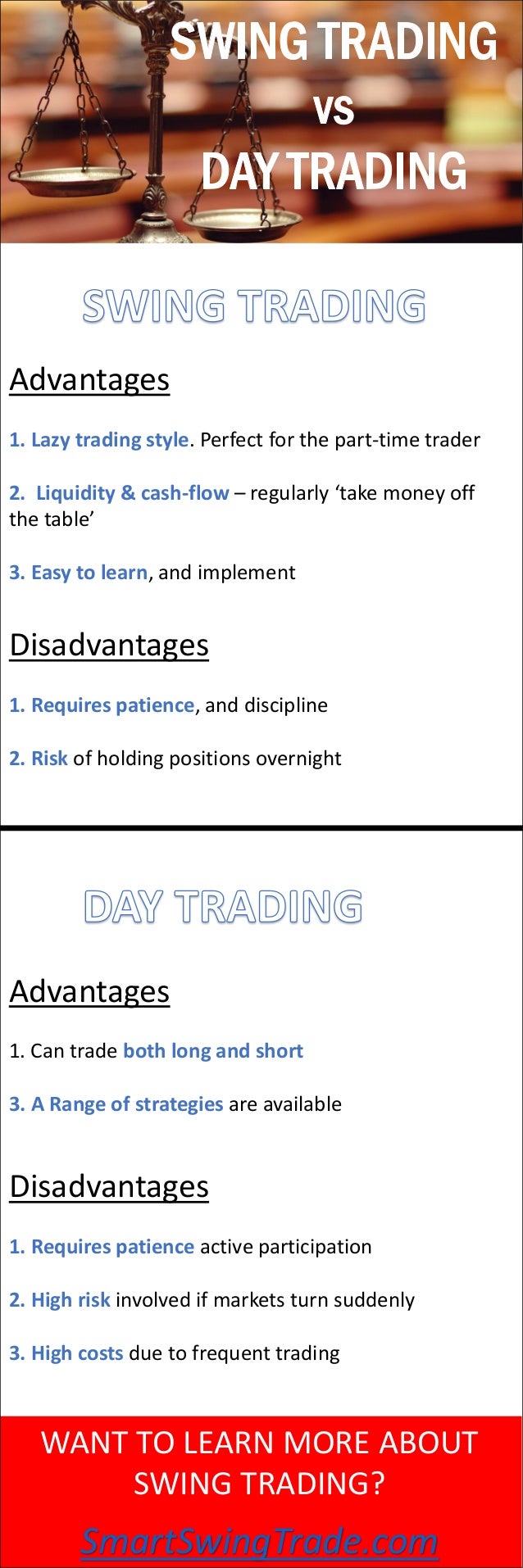

Day trading vs swing trading. Here are the differences as well as some pros and cons. A swing trade might take a couple of days to a couple of weeks to work out. Day trading, as well as swing trading, has pros and cons.

Unlike a day trader, a swing trader may take multiple days or weeks to close their position on an investment from the. Difference between day trading and swing trading. Swing trading shares similarities with day trading in that they’re short term positions.

Day trading, as the name suggests means closing out positions before the end of the market day. Capital requirements vary quite a bit across the different markets and trading styles. Pros and cons of scalping vs day trading vs swing trading.

Day trading is a comparison that many new investors will make. The distinction between swing trading and day trading is, usually, the holding time for positions. However, as chart patterns will show when you swing trade you take on the risk of overnight gaps emerging up or down against your position.

Day trading requires more time than swing trading, while both take a great deal of practice to gain consistency. Swing trading vs day trading. Swing trading is typically less time intensive and is usually practiced on higher time frames than day trading:

Whether day trading or swing trading is right for you is determined by the amount of time you can dedicate to trading, your goals, and you financial needs. Depending on the time horizon for a trade, the adjacent trading costs vary wildly. One of the most obvious key differences between day trading and swing trading is trading frequency.

Which helps you to understand the swing trading vs day trading. If you are an active trader, day trading and swing trading will feel like second cousins. Here is below mention some important differences are given below.

Technical analysis and it is based on stock patterns and charts whereas swing trading is somewhat relaxed than day trading as it refers to trading on weekly, monthly basis on a strategy basis to make plan. Day trading or swing trading. Let’s talk about the first factor:

The main difference is the holding time of a position. Day trading or swing trading that is the question. What is swing trading, swing vs.

One of the major attractions of swing. Swing trading the ultimate end goal for both day traders and swing traders is the same; In addition, new investors can determine which strategy best suits their interests in the stock market.

Or, the net profit at the end of a trading day or period. The holding periods — and therefore the technical tools being used — are what makes the difference. Day trading is very risky it’s not recommended for new traders.

Swing trading means taking a couple of trades per week, targeting to catch a full “swing” in a market, meaning they will be holding this position over a couple of days. Day trading, as the name indicates, involves making multiple trades for the ‘day’ or when the market you’re trading in is open. The main difference between swing and day trading is the time frame.

Or are you perhaps a mixture of all three? Trading costs are slightly lower in swing trading compared to day trading because of the smaller number of trades. When day trading, you need to sit in front of the computer.

There are two main factors that determine what’s better for you: On the other hand, swing trading is more suitable for traders who are able to see the big picture and don’t have the time to sit in front of the computer to monitor charting systems. Day traders can trade multiple times intraday, while swing traders can keep positions open for one to multiple days.

It’s a great opportunity to learn more about both investment strategies. Pros and cons of scalping vs day trading vs swing trading. Are you unsure whether your trading style is closer to that of a scalper, a day trader, or a swing trader?

Thus, the trading style affects the bottom line. Day trading makes the best option for action lovers. Swing trading and day trading are often compared.

In that situation, traders turn to either day trading or swing trading. Day trading involves making dozens of trades in a single day, while swing trading involves holding positions over a period of days or weeks. Swing traders can take trades which last for weeks and months.

November 05, 2018 12:49 utc reading time: Day trading vs swing trading. Day traders work with a short and limited time frame whereas the swing traders work with a much longer time frame.

Swing trading, often, involves at least an overnight hold,. Day trading refers to trading (buying and selling) in a single day to make profit based on security analysis method, i.e. Swing trading is based on identifying swings in supplies, assets, and also money that occur over a duration of days.

Swing trading vs day trading (infographic)

Swing trading vs day trading (infographic)

Day Trading vs Swing Trading Top 5 Best Differences

Day Trading vs Swing Trading Top 5 Best Differences

DayTrading, SwingTrading, and LongTerm Trading Raider

DayTrading, SwingTrading, and LongTerm Trading Raider

Swing Trading vs Day Trading Which is best for you

Swing Trading vs Day Trading Which is best for you

DAY TRADING vs. SWING TRADING for BITSTAMPBTCUSD by a.b

DAY TRADING vs. SWING TRADING for BITSTAMPBTCUSD by a.b

Day Trading vs Swing Trading Which Trading to Choose?

Day Trading vs Swing Trading Which Trading to Choose?

Swing Trading vs Day Trading vs Longterm Value Investing

Swing Trading vs Day Trading vs Longterm Value Investing

Swing Trading vs Day Trading Which is best for you

Swing Trading vs Day Trading Which is best for you

Day Trading Vs Swing Trading Trading In Action

Day Trading Vs Swing Trading Trading In Action

Day Trading vs Swing Trading 5 Key Differences

Day Trading vs Swing Trading 5 Key Differences

Swing Trading Course An Introduction To Profitable Short

Swing Trading Course An Introduction To Profitable Short

Swing Trading VS Day Trading Which Is Better? Asia

Swing Trading vs Day Trading ¿Cuál es la Mejor Estrategia

Swing Trading vs Day Trading ¿Cuál es la Mejor Estrategia

Swing Trading vs. Intraday Trading Which is Better

Swing Trading vs. Intraday Trading Which is Better

Day Trading Vs. Swing Trading Which Is Best For You

Day Trading Vs. Swing Trading Which Is Best For You

Day Trading vs. Swing Trading The Complete Guide

Day Trading vs. Swing Trading The Complete Guide

0 Comments